Have an Emergency? Call us now, 24/7

For 24/7 Emergency Restoration Services Call

Superior Restoration's Services

Fire & Smoke Damage

Experienced a small or large fire? COIT's expert restoration technicians will respond and communicate our process quickly and we will compassionately - return your life back to normal.

Mold Remediation

Finding mold can be scary. Make COIT your first call. Our mold remediation specialists will walk you through the process and remove any worries about the mold abatement process.

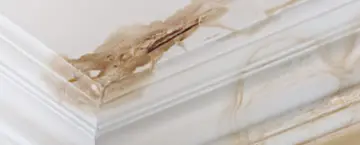

Water Damage

Bathrooms flood. Kitchens flood. Basements and more. Trust COIT's emergency restoration team has the knowledge, experience, and compassion to restore it back to it's beauty.

Content Restoration

In an emergency situation through fire or flood. A COIT Specialist will ensure your belongings are carefully cleaned and packed during the reconstructive processes. Because at COIT, we help put peoples lives back together.

Asbestos

If you're concerned with asbestos in your home or business. Our asbestos experts are certified for cleaning and removal of asbestos, making your home or business clean and healthy again.

Services for your Unique Restoration Needs

Trauma & Biohazard

We provide compassionate trauma and biohazard cleanup to employers, families, and communities after traumatic events such as homicides, suicides, unattended deaths, infectious disease outbreaks (COVID-19), accidents, and other biohazard situations. Cleaning up after a trauma or biohazard can be daunting and overwhelming, we are available 24/7 to help clean up.

Hoarding

Hoarding can be an issue with not only the amount of waste to dispose of, but the bacteria, and potential feces associated with it. Our expert Restoration Specialists are trained to handle all environments and We are available 24/7 to help clean up when in this situation.

Squatters

We deal safely and professionally with unsanitary conditions left by squatters: sharps, bodily fluids and all hazardous waste. We are available 24/7 to help clean up when in this situation.

Vandalism

If your home was the target of vandalism, COIT's experts are available 24/7 to help you in your time of need.

Where We Clean

Since 1938 Superior Cleaning and Restoration has helped home and business owners in the Seattle metro area repair, restore and replace damaged items after an emergency. In the 1990’s Superior Cleaning and Restoration became a COIT Services Company, combing two high-end companies with same goal - a commitment to delivering the best quality service for all our clients and customers.

With one of the largest emergency fleets in the Northwest, we are able to dispatch crews to a site 24/7. We answer all calls on the spot and is dispatched to an on-call Project Manager who will respond immediately.

When your home or business experiences an emergency, whether its water damage, mold remediation, or the discovery of asbestos, Superior’s expert restoration technicians can help. We not only repair your home and business, we can also help with property. Has a house flood ruined a hundred year old document of sentimental value, don't worry we have a solution for that too. Ask us about our Content Restoration.

Whether its water remediation or biohazard restoration, Superior’s Pros know how to handle any job. Go with the Pros you trust, Superior Cleaning and Restoration.

Superior Cleaning & COIT Cleaning and Restoration in Woodinville, WA holds a General Contractors license (SUPERI 973KR).

Contact Information

Phone: 425-287-5121

Email: info@coit.com

16750 Woodinville Redmond Rd.

NE Building C-103

Woodinville, WA98072